Hey, it’s Marc. ✌️

Your 100% signal on Web3 this week:

SEC wants innovation “sandbox” for on-chain trading

Coinbase introduces Smart Wallets

Robinhood acquires Bitstamp: Challenger to Coinbase?

Kraken’s upcoming IPO

Nvidia’s power play with a new AI chip

Consensus 2024 highlights

Christiano Ronaldo’s failed NFT sale

The Sandbox raises $20M

Let’s dive in. 🦈 | Read time: 4min

📚 Top 5 Reads

Food and Drink Brands in Gaming. By GEEIQ. Link

How We’re Thinking About AI. By Variant. Link

The state of AI in early 2024. By McKinsey & Company. Link

A marketplace for algorithms. By Jack Dorsey. Link

LLMs and AI agents get on-chain (audio). By Chain Reaction. Link

Pudgy Penguins: A Blueprint for Community-Led Brands. By Marc Baumann. Link

Boson Protocol – Real Web3 Commerce, with Web2 UX

As the next bull market emerges, so does a new crypto-rich, Web3-savvy demographic, who are demanding authentic Web3 commerce experiences. Uniquely, with Boson, you can sell physical things as NFTs, with a slick Web2 experience while running on a fully decentralized Web3 backend. No more Web3 washing required!

✨ Web3 & Consumer

Consensus 2024: All Eyes on Regulation🇺🇸

Consensus 2024, one of the biggest crypto & web3 conferences, wrapped up in Austin last week. It was highly political.

Highlights:

U.S. Independent Presidential candidate Robert F. Kennedy, advocated for recognition of decentralized currencies like Bitcoin, followed by a statement on Trump verdict on X.

A16z Crypto's Chris Dixon announced a $25M donation to Fairshake PAC to support pro-crypto candidates.

Cathie Wood, CEO of ARK Invest, stated that the approval of ether ETFs is due to crypto becoming a significant election issue

The CEO of Ripple ($45M contributor to Fairshake PAC) anticipates more crypto ETFs, including for XRP, Solana, and Cardano

Zooming in: Fairshake PAC is a pro-crypto political action committee that aims to support political candidates who favor responsible regulation of the crypto industry

Beyond Regulation: Goldman Sachs' Mathew McDermott emphasized tokenization's potential and called Bitcoin ETF approval as the "big psychological turning point.”

Punchline: The mood at Consensus 2024 was optimistic, driven by ETH ETF approval, FIT21 and a heating political debate in the US.

More on Web3:

Animoca Brands introduced Japanese NFT marketplace, SORAH. SORAH is designed to cater to the unique preferences and regulatory requirements of the Japanese market, offering a curated selection of NFTs from local creators and brands. Link

Coinbase introduced Smart Wallets. It allows onboarding with simple passkeys and enables gasless experiences. Link

Christiano Ronaldo sells only $10k NFTs in latest drop. Again: We’ve moved beyond simple NFT drops. Link

🌎 Crypto & Macro

Where there’s smoke💨 there’s fire🔥

Backed by BlackRock and Citadel Securities, TXSE Group plans to launch the Texas Stock Exchange in Dallas

Armed with a hefty $120M in funding, TXSE plans to file for US SEC registration later this year, commence trading in 2025, and unveil its initial listings by 2026.

Why it matters: These are of the largest asset managers in the world.

The TXSE is challenging NYSE and NASDAQ and could potentially run on a distributed ledger infrastructure, potentially Ethereum or Base.

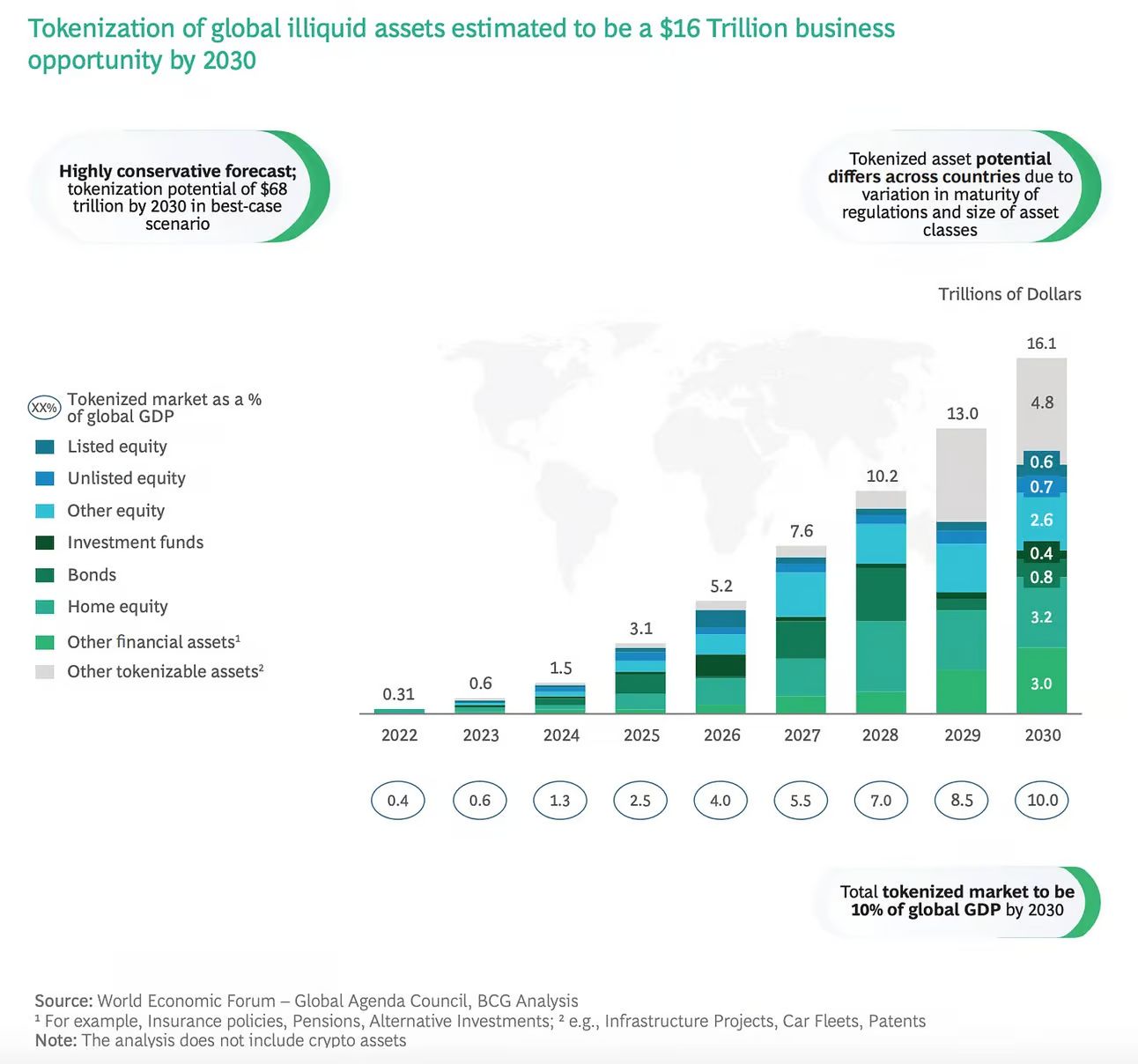

Larry Fink (CEO of BlackRock) has been talking about tokenization for the last 2 years. And the market is huge.

Only last year:

J.P. Morgan started tokenising funds as a proof-of-concept Link

Standard Chartered investment arm launches tokenization platform, “Libeara”. Link

Singapore Central Bank started tokenization pilots. Link

By the numbers:

Source: BCG

Meanwhile: SEC Commissioner Hester Peirce wants to create a "sandbox" for issuing, trading and settlement of securities on a distributed ledger.

In the same months it approved an Ethereum ETF.

Punchline: Where there’s smoke there’s fire. Usually.

More on Crypto:

Kraken in talks for pre-IPO fundraising round, IPO expected in 2025. They’ve been preparing for this for years. Link

Eigenlayer surpasses $20BN in TVL, becomes 2nd largest DeFi protocol. Link

The Sandbox raises $20M in convertible debt at $1B valuation, $SAND spikes. Link

Biden vetoes pro-crypto bill. Link

🔵 Get a 50% welcome discount on your PRO subscription—available for a limited time only!

A PRO subscription gets you:

Weekly Field Notes

2x/month case studies & data-driven industry analysis

Private community with exclusive content, virtual events, AMA’s with special guests & access to Marc

Access to top cheatsheets, lists & full archive

Can’t afford it? Reply to this email.

🎮 Gaming

Mythical Games announced a partnership with Pudgy Penguins to build an icy new mobile party game. Link

🧠AI

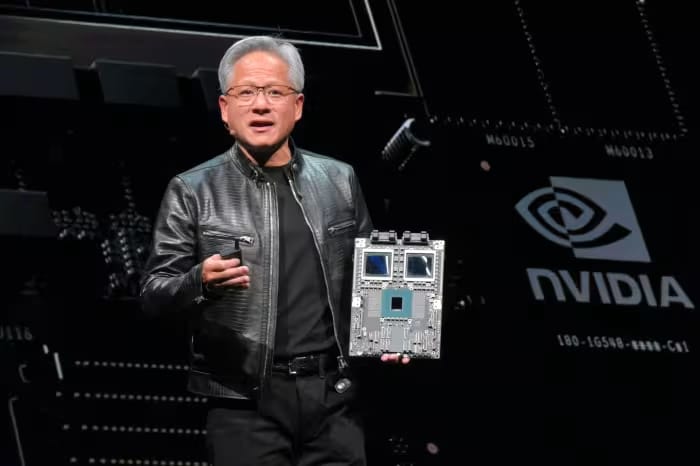

Nvidia’s Power Play 💪

Nvidia unveiled its next generation of AI chips, just months after announcing its previous model.

It’s the next iteration of high-bandwidth memory and will be released in 2026.

Not just any chip:

Nvidia plans to release a new AI chip every year with ‘Blackwell Ultra’ in 2025, and ‘Rubin’ in 2026, following ‘Rubin Ultra’ in 2027.

Rubin architecture, featuring 8-Hi HBM4 stacks, is expected to debut with R100 CPUs.

Rubin strengthens the market position of Nvidia as it has an estimated 80% market share in AI chips.

Why it’s important: By bringing powerful AI training capabilities to the edge, Rubin can enable a wider range of devices and applications to utilize advanced AI models.

This enables new possibilities in areas like autonomous vehicles, robotics, and healthcare.

Meanwhile: Nvidia flips Apple as stock hits $3 Trillion market cap amid AI boom. Link

🏗️ Start-ups & Tools to watch

*partner of FiftyOne Insights

💰 Money Moves

Twelve Labs Inc: Nvidia co-led a $50M round for an AI startup focused on video search. Link

The Sandbox: Metaverse gaming platform has raised $20M at $1B valuation. Link

That’s all for now, folks. Stay tuned for more on Memecoins and the big crypto consolidation.

Talk soon,

– Marc

(Source: MichaelParekh)

(Source: Mckinsey)

Partner with us

⚡️ Amplify Your Growth

We at FiftyOne Ventures work on this daily with a specialized & lean team – and some of the best partners of the industry.

Together with our global network of technology and execution partners, we accelerate start-ups and consumer brands to unlock next-gen consumer growth across Web3 and emerging technologies.

We’re also to offer our partners exposure to thousands of b2b Web3 industry leaders & access to the FiftyOne network to grow your business.

For advertisements: Get in touch today | For partnerships: Reply to this email.