Hey, it’s Marc. ✌️

Today, we'll dive into the state of fundraising with data-driven insights. This will help you navigate the space with confidence.

[👉 PRO subscribers: Access to raw data & pivot tables at the bottom].

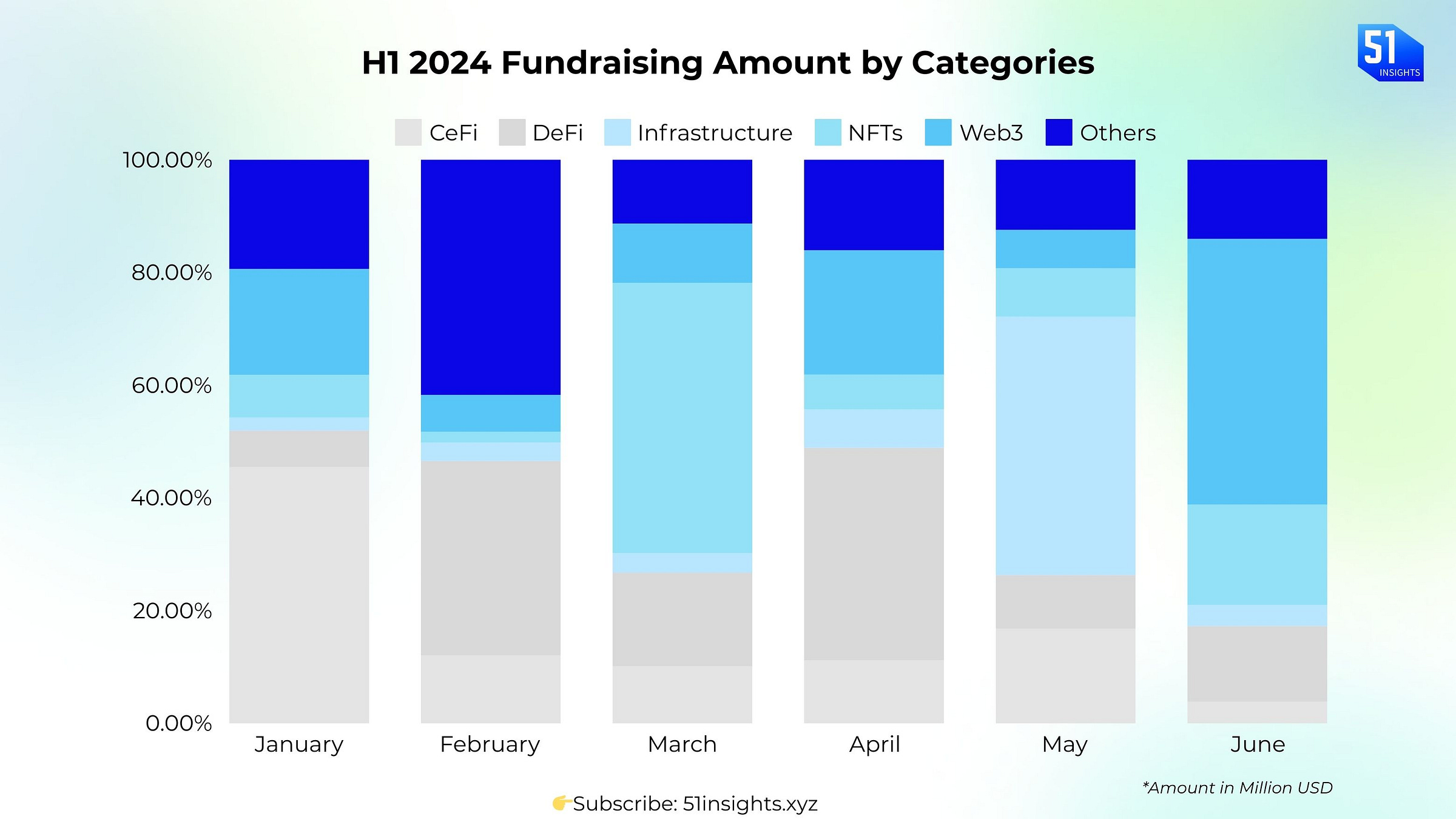

The first half of 2024 has seen a noticeable uptick in investor confidence within the Web3 space. Investors are prioritizing AI, blockchain infrastructure, and mainstream-friendly platforms, signaling a shift towards more integrated, secure, and user-centric Web3 ecosystems.

4 Key highlights:

AI is the new trend: The largest rounds went to AI cloud infrastructure company CoreWeave, which raised $7.5B in debt financing and $1.1B in Series B, followed by another AI startup, Mistral AI, which raised $640M to build foundational models to compete with OpenAI’s GPT-4o, Anthropic’s Claude 3 and Meta’s Llama 3.

Gaming as entry-point: 135 rounds were closed in GameFi with a $505.31M investment, led by Animoca Brands(26 deals) and The Spartan Group (18 deals). Blockchain Gaming Parallel's $35M raise for their sci-fi NFT card game hints at growing mainstream interest in blockchain gaming.

Early-stage and seed financing: Seed and early-stage financings remain active, with companies like Monad Labsand Farcaster attracting substantial investments. In the first half of 2024, 385 rounds were closed across pre-seed, seed, and Series A stages, totaling $2.58B in investment.

Notable Rounds

Here’s a list of the most notable rounds in H1, sorted by funding amount:

Consumer-Centric:

Polymarket: Prediction market platform raised $70M from big VCs, including Peter Thiel & Vitalik. Link

Igloo Inc.: Pudgy Penguins’ parent company raised $11M led by Founders Fund. Link

Gaming:

AI:

PerplexityAI: The “Google killer” announced a $73.6M Series B with a 520M valuation, led by IVP with Jeff Bezos participating. Link

Atropos Health, raised $33M in a Series B funding round, to accelerate pharmaceutical R&D with AI. Link

Blockchain & Infrastructure:

Iris Energy: Bitcoin mining firm raised $413M to scale up 30 EH/s in hash rate capacity and 510 MW in data center capacities. Link

Monad Labs: The blockchain development company led by Paradigm raised $225M. Link

Twelve Labs Inc: Nvidia co-led a $50M round for an AI startup focused on video search. Link

Solana: Second phase crosses 100,000 presales, securing $45M for development. Link

Movement Labs: Closed $38M series A round led by Polychain Capital. Link

Humanity Protocol: Identity platform utilizing biometrics raised $30M in seed funding led by Kingsway Capital, achieving unicorn status despite being less than a year old.

IO Research: Solana-based DePIN developer raised $30M Series A with a token valuation of $1B. Link

DeFi

Eigenlayer: The Ethereum restaking protocol raised $100M from a16z. Link

Figure Technologies: Fintech company raised $60M to build large, novel decentralized exchange. Link

CeFi

HashKey Group: The Hong Kong crypto exchange's new unicorn with a $1.2B valuation after a $100M raise. Link

Securitize: Tokenization firm raised $47M led by BlackRock. Link

Other Web3:

⚡️ Amplify Your Growth

Building a Web3 business OR looking to innovate with Web3 tools? FiftyOne Labs is your unfair advantage. Powered by FiftyOne Insights, we combine what we know and who we know to help you win:

Capturing market & mind share with our 50k+ b2b audience

Full-stack content outsourcing

Developing a go-to-market and growth strategy

Reaching potential partners or clients

We have 2 available slots.

Notable funds & other investments:

Pantera Capital targets a $1B fund to fuel AI and blockchain innovation. Link

Polygon launched a $720M grants program. Link

Publicis Groupe: World’s 2nd largest comms group makes $300M investment into AI. Link

Galaxy Asset Management, which announced it closed $113 million for a new venture capital fund. Galaxy Ventures Fund will focus on early-stage crypto companies. Link

Kasikornbank: The bank launched a $100m fund to boost AI and Web3 startups. Link

Immutable and Polygon partnered with VC firm King River Capital to launch the $100M ‘Inevitable Games Fund’. Link

Anthropic and Menlo Ventures have launched a $100M ‘Anthology fund’ to support early-stage AI startups. Link

RW3 Ventures launched a $60M early-stage venture fund focused on Web3. Link

Marc Andreessen granted $50K to Truth Terminal, an AI agent on X, for upgrades and projects after it personally requested funding. Link

Paper Ventures: Blockchain VC fund launched with a $25M fund to invest in early-stage Web3 + blockchain startups.

The most notable VC funds in H1 2024

OKX Ventures: The venture firm has evolved as a leading investor in categories like DeFi, blockchain, and infrastructure with 58 deals in H1 2024 out of 186 total investments.

Bracebridge: Capital firm invests $363M in Bitcoin ETFs, including ARKB, IBIT, and GBTC as institutions continue to increase BTC ETF investments.

Animoca Ventures: Animoca Ventures, the venture arm of Animoca Brands, closed 60 deals in H1 2024. It contributed $6M to Animoca's total bookings in Q1 2024, as part of the company's Investment Management category, which includes realized gains from digital asset investments and fees.

Founder’s Fund: The global venture capital firm made a total of 897 investments across its various funds. It has raised several multi-billion dollar funds, including a $1.9B Founders Fund VIII and a $3.4B Founders Growth Fund.

Notable Angels

Dingaling and Sandeep Nailwal have closed 21 deals each in H1 2024, followed by DCF God (17 deals), Santiago (13 deals), Balaji (12 deals), and others.

So what?

The first half of 2024 showcased VCs' focus on AI, blockchain services, blockchain infrastructure, gaming, and consumer-centric applications. The convergence of AI and Web3 is particularly notable, with significant investments. The continued flow of capital into blockchain AI projects underscores consumer engagement with emerging technologies and a shift in digital experiences.

That’s all for now, folks.